If you wish to entrust us your portfolio management or if you want to actively manage your assets, we have the solution.

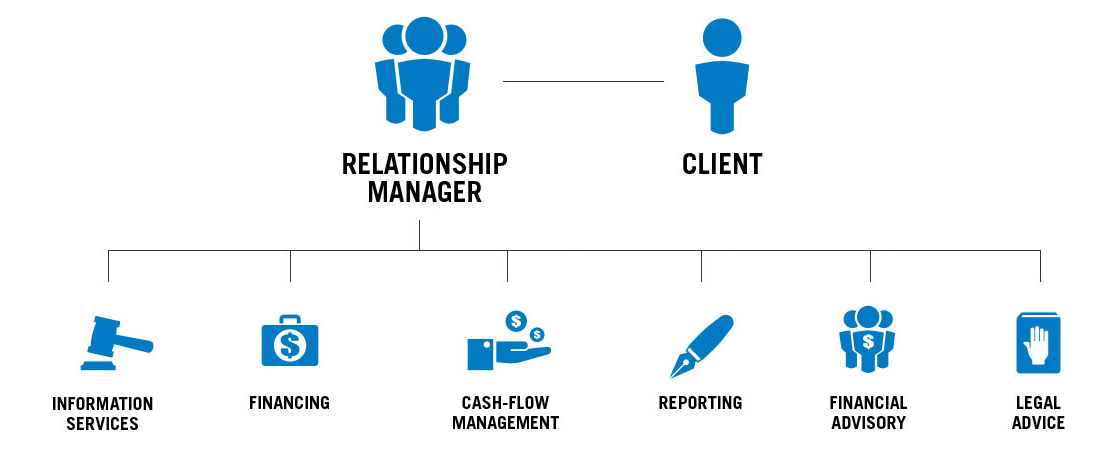

RELATIONSHIP

MANAGEMENT

A dedicated Relationship Manager provides permanent availability and specialized assistance for daily account management tasks as well as for investment decisions, and will act as an “ambassador” who helps coordinate and manage Clients needs.

Dedicated

Financial Advisory

Relationship Managers are supported by a fully dedicated Financial Advisory team with permanent access to top tier financial services providers, benefiting from constantly updated information and being able to provide Clients with adequate proposals and suggestions.

Financial

Advisory

Personalized Financial Advisory Mandate will allow the Client to be actively involved in the investment decisions through the Relationship Manager with permanent access to BPI (SUISSE)’s investment strategy and proposals.

Control

your own portfolio

We offer a dynamic service from a Financial Advisory perspective, guided by a transparent approach and strongly focused on the Client’s needs.

-

CUSTOMIZED UPDATESPersonalized account statement and a flexible, transparent and up-to-date investment approach.

CUSTOMIZED UPDATESPersonalized account statement and a flexible, transparent and up-to-date investment approach. -

OPEN ARCHITECTUREAccess to an open architecture structure that offers best in class products and services.

OPEN ARCHITECTUREAccess to an open architecture structure that offers best in class products and services. -

INVESTMENT ADVISORYIndividualized strategic asset allocation approach, combining BPI (SUISSE)’s investment strategy with our dedicated Investment Advisory team.

INVESTMENT ADVISORYIndividualized strategic asset allocation approach, combining BPI (SUISSE)’s investment strategy with our dedicated Investment Advisory team. -

TAILORED PROPOSALSProactive investment proposals in line with Clients individual goals and risk tolerance, through a disciplined advisory approach.

TAILORED PROPOSALSProactive investment proposals in line with Clients individual goals and risk tolerance, through a disciplined advisory approach.

DISCRETIONARY

MANAGEMENT

A Discretionary Portfolio Management Mandate solution will be suitable for Clients who wish to entrust the management of their portfolio to a specialized team.

Delegate

to the experts

This service is a tailor-made approach to the management of diversified investment portfolios for Clients.

-

TRUSTED EVALUATIONThe investment strategy starts with the definition of the Client’s Risk Profile.

TRUSTED EVALUATIONThe investment strategy starts with the definition of the Client’s Risk Profile. -

OPEN ARCHITECTUREAccess to an open architecture structure that offers best in class products and services.

OPEN ARCHITECTUREAccess to an open architecture structure that offers best in class products and services. -

INVESTMENT PHILOSOPHYOur main goal is to add value by analyzing the macroeconomic context in order to define the best strategic asset allocation in each moment.

INVESTMENT PHILOSOPHYOur main goal is to add value by analyzing the macroeconomic context in order to define the best strategic asset allocation in each moment. -

global Investment ProcessThe Financial Advisory team interacts with the main market players, combining this information with the input from an Investment Committee.

global Investment ProcessThe Financial Advisory team interacts with the main market players, combining this information with the input from an Investment Committee.